The Adoption Credit Calculator is a valuable tool designed to help prospective adoptive parents estimate the financial support they can receive through the Adoption Tax Credit (ATC). This non-refundable credit is provided by the IRS to offset the costs associated with adopting a child. By using the calculator, families can better understand their potential tax savings, aiding in financial planning and making the adoption process more affordable.

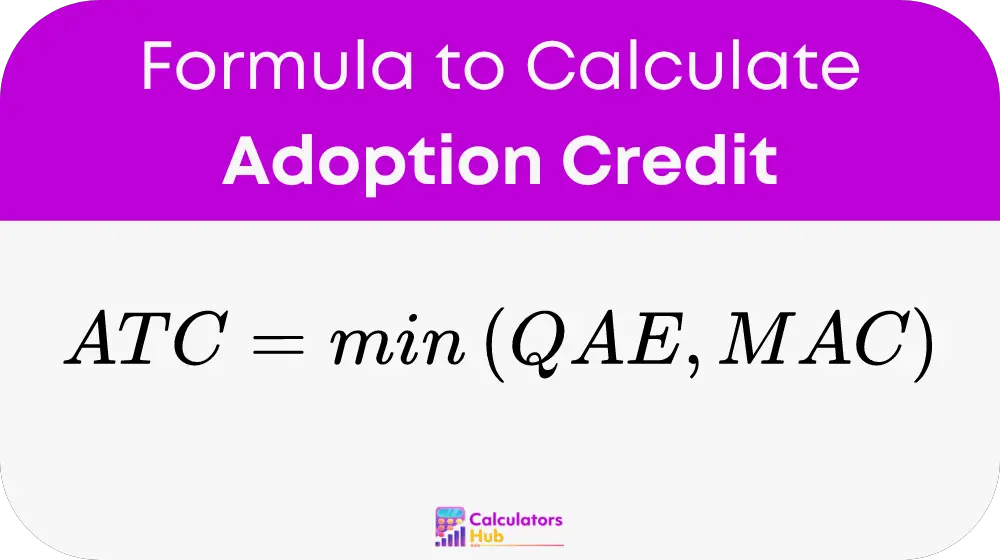

Formula of Adoption Credit Calculator

The formula for calculating the Adoption Tax Credit (ATC) is:

Where:

- ATC: Adoption Tax Credit

- QAE: Qualified Adoption Expenses

- MAC: Maximum Adoption Credit limit set by the IRS for the given tax year

Detailed Explanation

- Qualified Adoption Expenses (QAE):

- These are reasonable and necessary expenses directly related to the legal adoption of an eligible child. Examples include:

- Adoption fees paid to an agency

- Court costs

- Attorney fees

- Travel expenses (including meals and lodging) necessary for the adoption

- These are reasonable and necessary expenses directly related to the legal adoption of an eligible child. Examples include:

- Maximum Adoption Credit (MAC):

- This is the maximum limit for the adoption credit set by the IRS each year. For instance, if the MAC for the tax year is $14,300, the maximum amount you can claim as a credit is $14,300.

Table for General Terms and Quick Calculations

Here’s a table to help you quickly reference and understand common terms related to the Adoption Tax Credit:

| Term | Definition |

|---|---|

| Qualified Adoption Expenses | Expenses directly related to the legal adoption of a child, such as fees and travel. |

| Maximum Adoption Credit | The maximum credit amount set by the IRS for a given tax year. |

| Non-refundable Credit | A tax credit that can reduce your tax liability to zero but not below zero. |

Example of Adoption Credit Calculator

Consider a family that incurred the following expenses for adopting a child:

- Adoption agency fees: $5,000

- Court costs: $2,000

- Attorney fees: $3,000

- Travel expenses: $4,000

- Total Qualified Adoption Expenses (QAE): $14,000

If the Maximum Adoption Credit (MAC) for the year is $14,300, then: ATC = min(14,000, 14,300) = $14,000

This example shows that the family can claim a credit of $14,000, helping to significantly reduce their tax liability for the year.

Most Common FAQs

A1: Qualified expenses include adoption agency fees, court costs, attorney fees, and necessary travel expenses related to the adoption process.

A2: Yes, if the credit exceeds your tax liability for the year, you can carry forward the unused portion to future tax years, up to a maximum of five years.

A3: Yes, the credit is available for both domestic and international adoptions, provided the adoption meets the IRS’s eligibility criteria.