The Annual Percentage Cost (APC) Calculator is an invaluable tool for individuals and businesses evaluating the total cost of borrowing. By incorporating all fees and interest payments, the APC provides a comprehensive annual percentage rate that helps borrowers compare different loan offers on a level playing field, ensuring they make informed financial decisions.

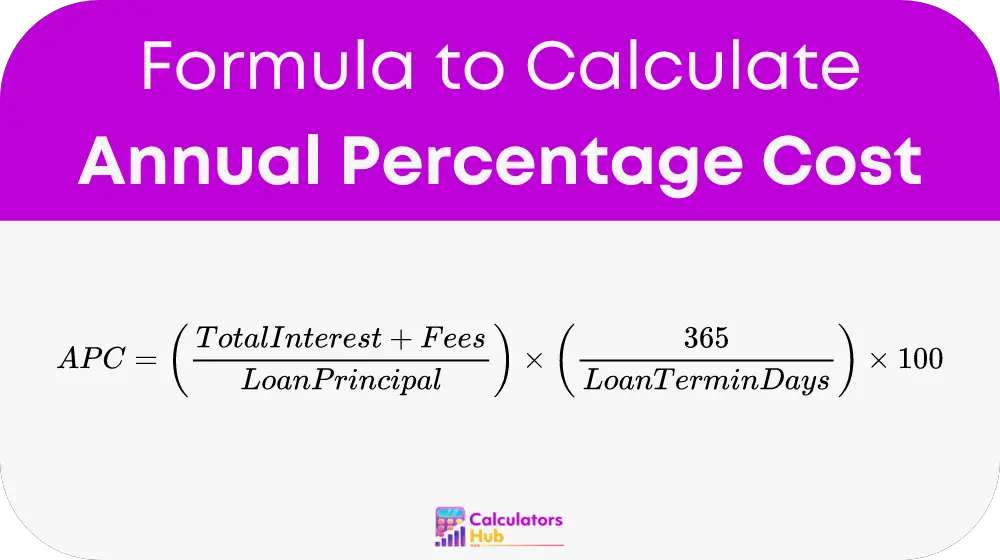

Formula of Annual Percentage Cost Calculator

The APC can be expressed through the following formula:

Components Defined:

- Total Interest: The aggregate amount of interest paid over the entire term of the loan.

- Fees: This includes any additional charges associated with the loan, such as origination fees, administrative fees, and maintenance fees.

- Loan Principal: The original sum borrowed.

- Loan Term in Days: The duration of the loan expressed in days.

- 365: Represents the number of days in a year, used to annualize the cost (this could be adjusted to 360 for financial calculations based on the banking year).

Detailed Calculation Steps:

- Determine Total Interest: Calculate the total amount of interest paid throughout the loan term.

- Sum Up All Fees: Compile all fees charged in association with the loan.

- Calculate Total Loan Cost: Add the total interest and all fees to determine the overall cost of the loan.

- Fraction of Principal: Divide this total loan cost by the loan principal to get a ratio.

- Annualize the Cost: Multiply this ratio by (365 / Loan Term in Days) to scale it to an annual basis.

- Convert to Percentage: Multiply the result by 100 to convert the ratio into a percentage.

Table of General Terms

To clarify the terms used in APC calculations, here's a helpful glossary:

| Term | Definition |

|---|---|

| Total Interest | The complete amount of interest payable over the duration of the loan. |

| Fees | Additional costs tied to the loan beyond the interest. |

| Loan Principal | The initial amount of money borrowed. |

| Loan Term in Days | The total number of days from the start to the end of the loan. |

| Annual Percentage Cost (APC) | The percentage that represents the total yearly cost of the loan as a proportion of the loan principal. |

Example of Annual Percentage Cost Calculator

Scenario: An individual takes out a $10,000 loan with a term of 180 days. The interest charged is $300, and there are additional fees totaling $200.

Calculation:

- Total Loan Cost = $300 (interest) + $200 (fees) = $500

- Fraction of Principal = $500 / $10,000 = 0.05

- Annualize the Cost = 0.05 * (365 / 180) ≈ 0.101

- APC = 0.101 * 100 = 10.1%

This example demonstrates that the loan has an annual cost rate of 10.1% when considering all fees and interest.

Most Common FAQs

The APC is similar to the Annual Percentage Rate (APR), but it specifically emphasizes the total cost of the loan including all fees, not just the interest rate.

Calculating the APC helps borrowers understand the true cost of a loan, comparing offers objectively and making financially sound decisions.

Yes, understanding the APC can empower borrowers to negotiate better terms by clearly understanding the breakdown and impact of fees and interest rates.