The Annual Equivalent Rates Calculator (AER) helps investors and savers determine the actual interest rate on an investment or savings account, considering the effect of compounding. This rate provides a standardized measure to compare the returns on different financial products with varying compounding intervals, making it an essential tool for anyone looking to optimize their investment returns.

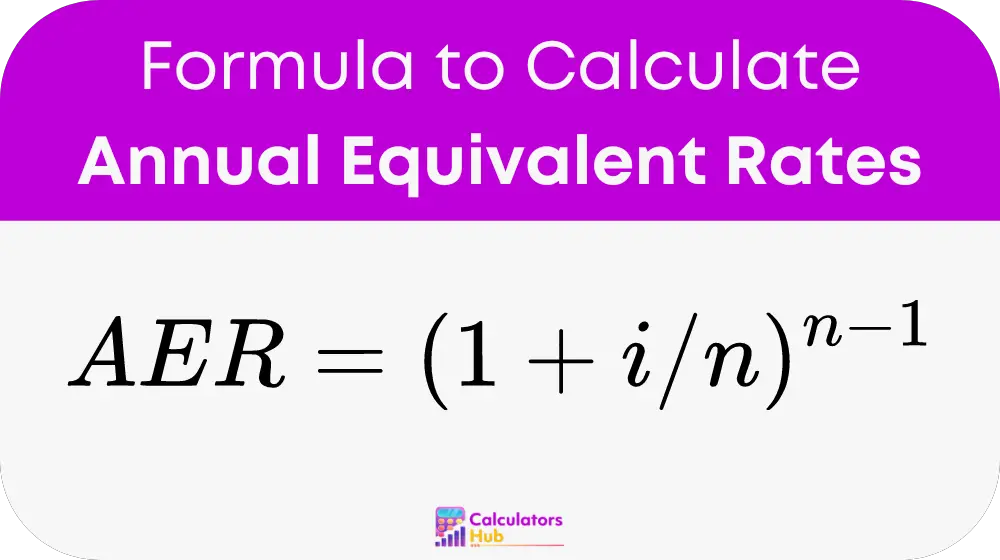

Formula of Annual Equivalent Rates Calculator (AER)

To calculate the Annual Equivalent Rate, the formula is:

Where:

- i = Nominal annual interest rate (expressed as a decimal)

- n = Number of compounding periods per year

This formula helps investors determine the actual annual rate of return, allowing for an apples-to-apples comparison across various financial products with different compounding intervals.

Table for General Terms

For convenience, here is a quick reference table for terms related to AER:

| Term | Definition |

|---|---|

| Compounding | The process where interest is earned on both the initial principal and the accumulated interest. |

| Nominal Rate | The stated interest rate of an investment or loan without compounding. |

| Effective Interest Rate | The interest rate calculated after the effects of compounding. |

This table assists in understanding commonly used financial terminologies, which are crucial for effective investment planning.

Example of Annual Equivalent Rates Calculator (AER)

Consider a $1,000 investment with a nominal interest rate of 3% compounded quarterly. Using the AER formula:

AER = (1 + 0.03/4)^4 - 1 = 0.0304 or 3.04%

This result demonstrates that the effective annual rate exceeds the nominal rate due to quarterly compounding.

Most Common FAQs

AER provides a more accurate measure of what an investor will actually earn in a year by accounting for the effects of compounding. It's more indicative of the true earning potential of an investment.

AER allows for an equitable comparison between different financial products by normalizing the effects of different compounding frequencies, making it easier to identify which investment offers the best return.

Yes, AER is applicable to any investment or savings that involves interest, making it a universal tool for evaluating the potential return on various financial products.