The Accounting Rate of Return (ARR) Calculator is a useful tool in financial analysis that helps investors assess the profitability of an investment by measuring the average annual profit generated relative to the initial investment. In simple terms, it provides a quick way to evaluate the potential return on investment (ROI) of a project or business endeavor.

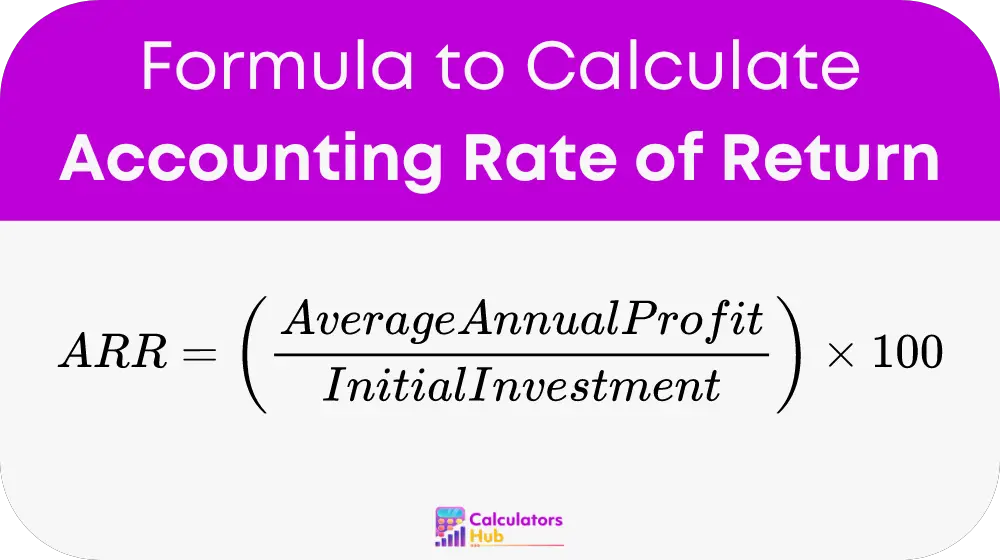

Formula of Accounting Rate of Return Calculator

The formula for calculating the Accounting Rate of Return (ARR) is straightforward:

Where:

- Average Annual Profit is calculated as the sum of net profits for each year divided by the number of years.

- Initial Investment is the initial amount of money invested in the project.

To further detail the calculation:

Average Annual Profit = Sum of Annual Profits / Number of Years

General Terms and Conversions

Below is a table of general terms related to ARR calculation that people commonly search for, providing helpful insights and conversions:

| Term | Description |

|---|---|

| Net Profit | The total profit generated after subtracting all expenses. |

| Initial Investment | The initial amount of capital invested in the project. |

| ROI | Return on Investment, a measure of the profitability of an investment. |

| Percentage | A portion of 100, often used to express ARR and other financial metrics. |

Example of Accounting Rate of Return Calculator

Let’s consider a practical example to illustrate how the ARR Calculator works:

Suppose Company X invests $100,000 in a project and expects to generate the following net profits over a period of 5 years:

- Year 1: $20,000

- Year 2: $25,000

- Year 3: $30,000

- Year 4: $35,000

- Year 5: $40,000

Using the ARR formula:

Average Annual Profit = (20,000 + 25,000 + 30,000 + 35,000 + 40,000) / 5 = $30,000

Now, plug the values into the ARR formula:

ARR = ($30,000 / $100,000) * 100 = 30%

So, the ARR for Company X’s project is 30%.

Most Common FAQs

The Accounting Rate of Return (ARR) is a financial metric use to evaluate the profitability of an investment by comparing the average annual profit to the initial investment.

The ARR is calculated by dividing the average annual profit by the initial investment and expressing the result as a percentage.

ARR helps investors assess the potential return on investment (ROI) of a project or business endeavor, aiding in decision-making and financial planning.