Prorated bonuses are typically awarded when an employee has not worked the full bonus period, such as a fiscal year or between performance review cycles. The Prorate Bonus Calculator helps in determining the exact amount to be paid to an employee based on the actual time worked during the bonus period.

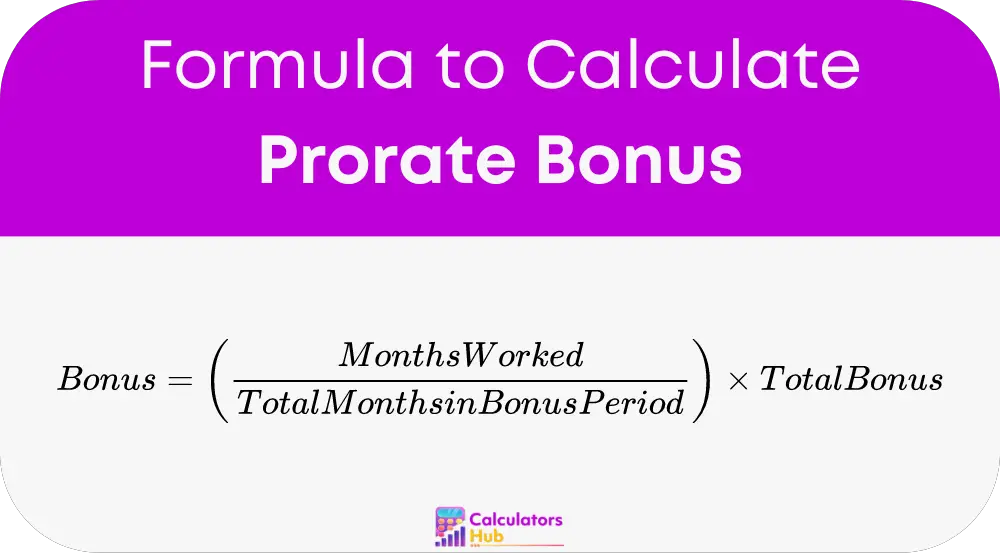

Formula of Prorate Bonus Calculator

The calculation of a prorated bonus can be understood through the following formula:

Components:

- Months Worked: This is the count of months the employee was actively employe during the bonus eligibility period.

- Total Months in Bonus Period: This represents the full duration for which the bonus is calculate, typically a year.

- Total Bonus Amount: This is the aggregate bonus amount set aside for employees for the full period.

Table of General Terms

Here is a helpful table of terms commonly use when discussing prorated bonuses:

| Term | Definition |

|---|---|

| Prorated Bonus | Bonus adjusted based on the proportion of the bonus period worked. |

| Bonus Period | The time span over which bonus performance is evaluated. |

| Full Bonus | The total bonus amount before any proration. |

Example of Prorate Bonus Calculator

Consider an employee who started work on April 1 and the bonus period ends on December 31. If the total bonus pool is $12000, the calculation would be:

Months Worked: 9 (April to December) Total Months in Bonus Period: 12 (January to December) Total Bonus Amount: $12000

Using our formula: Prorated Bonus = (9 / 12) * $12000 = $9000

The employee would be eligible for a prorated bonus of $9000.

Most Common FAQs

A: The prorated bonus formula ensures that employees receive compensation proportional to their time worked during the bonus period.

A: While the calculator does not deal with taxes directly, prorated bonuses are taxable income. Employees should consult with a tax professional for specific advice.

A: The calculator can be use to compute bonuses for multiple employees by entering their respective data separately or by using batch processing tools if available.