A Debt Free Date Calculator helps individuals determine when they will become debt-free by calculating the number of payments required to clear their outstanding balance. This tool is essential for financial planning as it provides a realistic timeline for debt repayment based on the current debt amount, interest rate, and fixed monthly payments. It helps users understand how long it will take to pay off their debt, make informed decisions about increasing payments to clear debt faster, and plan their financial future with a clear debt repayment timeline. The calculator is particularly useful for individuals managing credit card debt, personal loans, or other liabilities, helping them strategize a debt-free plan effectively.

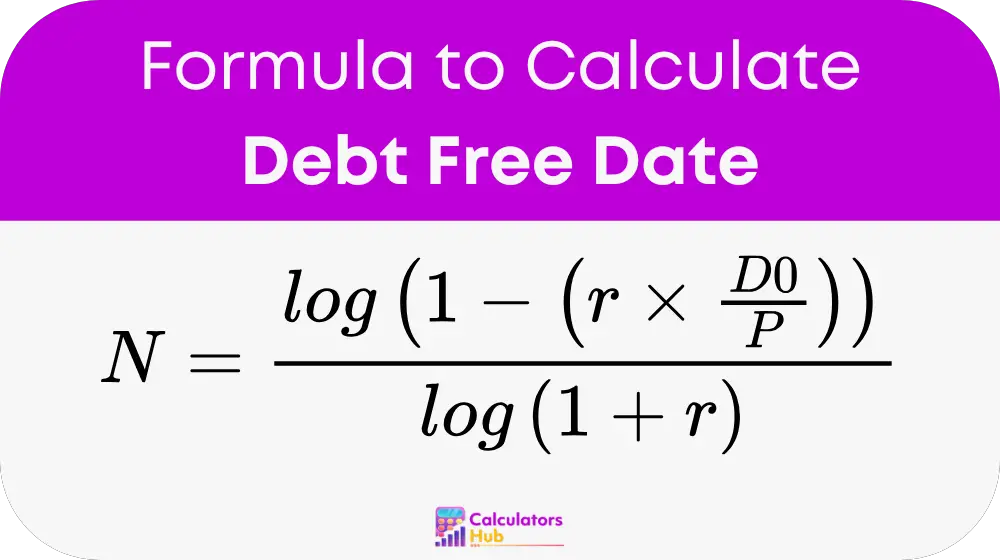

Formula for Debt Free Date Calculator

The formula used to calculate the total number of payments required to become debt-free is:

Where:

N = Total number of payments required to become debt-free

D0 = Initial debt amount

r = Interest rate per period (expressed as a decimal)

P = Fixed payment per period

This formula helps in determining how many payments are needed to clear the outstanding balance by considering the principal amount, the interest rate, and the payment amount per period.

Debt-Free Repayment Table

To make it easier for users, the following table provides approximate timelines based on different loan amounts, interest rates, and fixed monthly payments. This helps people estimate their debt-free date without manually calculating each time.

| Initial Debt ($) | Interest Rate (%) | Monthly Payment ($) | Approximate Time to Pay Off (Months) | Approximate Time to Pay Off (Years) |

|---|---|---|---|---|

| 5,000 | 5% | 200 | 27 | 2.25 |

| 10,000 | 7% | 300 | 40 | 3.33 |

| 15,000 | 10% | 400 | 48 | 4.00 |

| 20,000 | 12% | 500 | 55 | 4.58 |

| 25,000 | 15% | 600 | 61 | 5.08 |

The above table provides estimated debt-free periods assuming a fixed monthly payment without any extra payments.

Example of Debt Free Date Calculator

Let’s say an individual has a credit card balance of $10,000 at an annual interest rate of 12% and makes fixed monthly payments of $300.

- Convert the annual interest rate to a monthly rate:

Monthly Interest Rate = 12% ÷ 12 = 1% = 0.01 - Apply the values to the formula:

N = log(1 - (0.01 × 10,000 ÷ 300)) ÷ log(1 + 0.01) - Compute the result:

N ≈ 42.5 payments

So, it will take approximately 43 months (3.6 years) to become debt-free if the person consistently pays $300 per month.

Most Common FAQs

Yes, increasing your monthly payments reduces the number of payments required to clear your debt. This helps you save on interest and become debt-free sooner.

A higher interest rate increases the total repayment period because a portion of each payment goes towards interest rather than the principal balance. Lowering interest rates through refinancing or balance transfers can shorten your debt repayment timeline.

Missing a payment can extend your debt-free timeline, increase interest costs, and negatively impact your credit score. It is advisable to make at least the minimum required payment on time.