The Cost Margin Calculator is a financial tool used to determine the gross profit margin and cost margin of a business. It helps evaluate how much of the sales revenue is retained as profit after accounting for the cost of goods sold (COGS). Additionally, it identifies the percentage of revenue consumed by production or purchase costs.

Businesses use this calculator to measure profitability, set pricing strategies, and make informed financial decisions. By providing precise and actionable insights, the calculator ensures that companies can optimize their operations and maximize profitability.

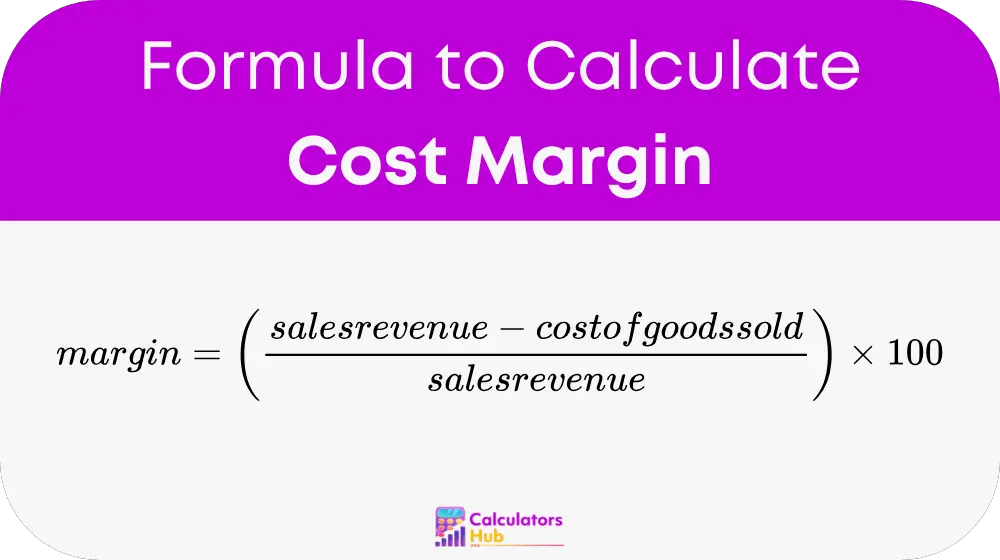

Formula of Cost Margin Calculator

The formula for calculating the gross profit margin is:

Detailed Formula Components

- Sales Revenue:

The total income generated from selling goods or services, measured in monetary units such as dollars. - Cost of Goods Sold (COGS):

The total expenses incurred to produce or purchase the goods sold. This includes raw materials, labor, and other direct costs. - Cost Margin:

The percentage of sales revenue spent on COGS, calculated as:

cost_margin = (cost_of_goods_sold / sales_revenue) × 100 - Gross Profit Margin:

The percentage of sales revenue retained as profit after subtracting COGS, calculated as:

gross_profit_margin = [(sales_revenue – cost_of_goods_sold) / sales_revenue] × 100

Key Notes:

- A higher gross profit margin indicates better profitability.

- A lower cost margin reflects efficient cost management.

General Terms Table

Below is a reference table for common sales and cost scenarios:

| Sales Revenue ($) | Cost of Goods Sold ($) | Gross Profit Margin (%) | Cost Margin (%) |

|---|---|---|---|

| 100,000 | 40,000 | 60% | 40% |

| 200,000 | 100,000 | 50% | 50% |

| 500,000 | 300,000 | 40% | 60% |

| 1,000,000 | 750,000 | 25% | 75% |

| 250,000 | 150,000 | 40% | 60% |

This table provides ready-made benchmarks for businesses to assess their cost and profit margins.

Example of Cost Margin Calculator

Scenario:

A retail business reports the following financial data:

- Sales Revenue: $250,000

- Cost of Goods Sold (COGS): $150,000

Calculation:

Step 1: Calculate the Gross Profit Margin

Using the formula:

gross_profit_margin = [(250,000 – 150,000) / 250,000] × 100

gross_profit_margin = [100,000 / 250,000] × 100 = 40%

Step 2: Calculate the Cost Margin

Using the formula:

cost_margin = (cost_of_goods_sold / sales_revenue) × 100

cost_margin = (150,000 / 250,000) × 100 = 60%

Interpretation:

- The gross profit margin is 40%, meaning 40% of the sales revenue is retained as profit after covering the cost of goods sold.

- The cost margin is 60%, indicating that 60% of the revenue is spent on production costs.

Most Common FAQs

The calculator helps businesses determine profitability and cost efficiency. By calculating gross profit and cost margins, it allows businesses to assess performance and identify areas for cost reduction.

A good gross profit margin depends on the industry. For example, retail businesses may aim for 20–40%, while service-based industries often achieve margins of 50% or more. Higher margins indicate better profitability.

Businesses can reduce their cost margin by negotiating better supplier contracts, improving operational efficiency, or optimizing production processes. Lowering COGS directly increases gross profit margins.