The Annuity Exclusion Ratio Calculator is an essential tool for individuals receiving annuity payments who need to determine how much of each payment is not subject to income tax. This calculation helps annuitants understand what portion of their annuity payment constitutes a return of their principal investment, thus not taxable, versus what portion is considered earnings, which is taxable. This distinction is crucial for accurate financial planning and tax reporting.

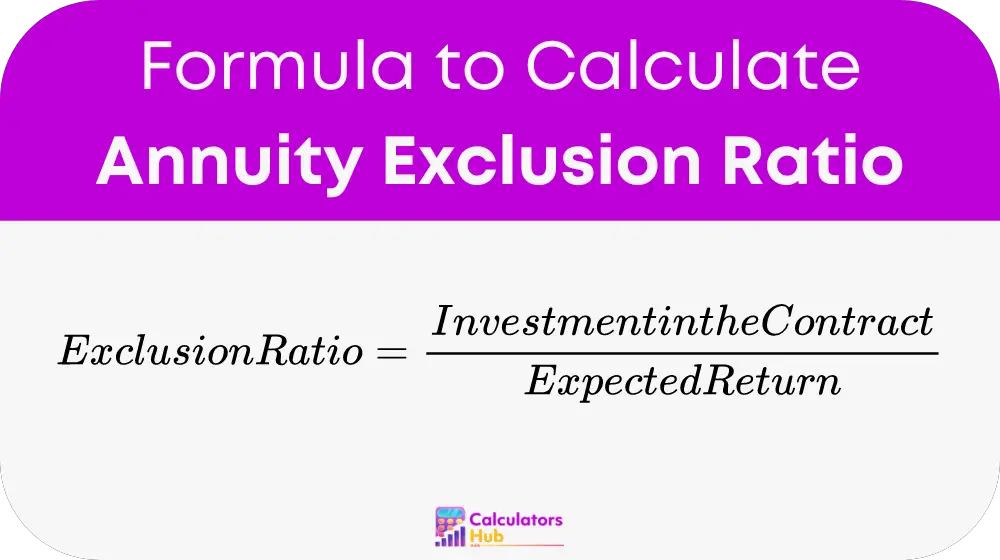

Formula of Annuity Exclusion Ratio Calculator

The formula to calculate the Annuity Exclusion Ratio is:

Detailed Breakdown of the Formula:

- Investment in the Contract: This is the total sum paid into the annuity, which represents the non-taxable return of the annuitant's principal.

- Expected Return: This is the total amount that the annuitant expects to receive back from the annuity over its term, calculated at the outset of the annuity agreement.

Steps for Accurate Calculation:

- Identify the Investment in the Contract: Note the total amount initially invested into the annuity.

- Calculate the Expected Return: This includes all payments expected from the annuity over its duration as initially agreed upon.

- Compute the Exclusion Ratio: Divide the investment by the expected return to find out what fraction of each annuity payment is not taxable.

Table of General Terms

To aid understanding, here's a glossary for terms associated with the Annuity Exclusion Ratio Calculator:

| Term | Definition |

|---|---|

| Annuity | A financial product that pays out a fixed stream of payments to an individual, primarily used as an income stream for retirees. |

| Exclusion Ratio | The fraction of an annuity payment that is considered a return of principal and is not subject to income tax. |

| Investment in Contract | The initial sum paid into the annuity contract by the annuitant. |

| Expected Return | The total amount that the annuity is expected to pay out over its operational term. |

Example of Annuity Exclusion Ratio Calculator

Scenario: An individual invests $100,000 in an annuity that is expect to return $150,000 over 20 years.

Calculation:

- Investment in the Contract: $100,000

- Expected Return: $150,000

- Exclusion Ratio = $100,000 / $150,000 = 0.6667 or 66.67%

This means that 66.67% of each annuity payment will not be tax as it is consider a return of the principal amount invest.

Most Common FAQs

It helps annuitants accurately report their taxable income and plan their taxes effectively.

Once set base on the initial terms of the annuity contract, the exclusion ratio remains constant throughout the life of the annuity unless the terms are alter.

Knowing how much of your annuity is taxable affects how much money you will net over time and can influence decisions on budgeting and spending.