AMT Depreciation is designed to ensure that certain taxpayers pay at least a minimum amount of tax. It recalculates depreciation under different rules to increase taxable income, thereby increasing the taxpayer’s tax liability. Unlike standard depreciation, which aims to reflect an asset’s actual wear and tear, AMT Depreciation adjusts the value for tax purposes, often leading to higher taxable income.

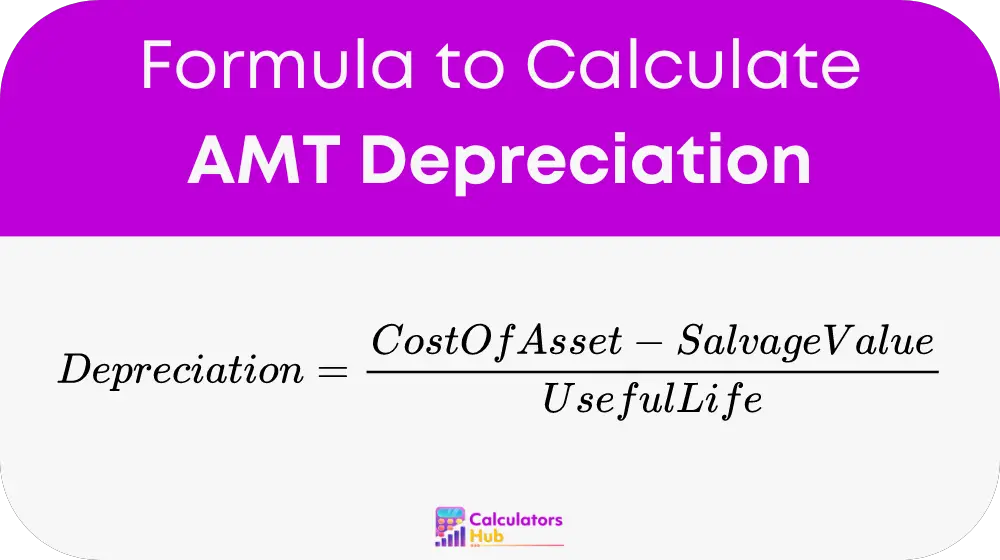

Formula of AMT Depreciation Calculator

Straight-Line Method

To calculate depreciation using the straight-line method:

- Cost of Asset: The amount paid to acquire the asset.

- Salvage Value: The expected value of the asset at the end of its useful life.

- Useful Life: The period over which the asset is anticipated to be used by the business.

Declining Balance Method

For the declining balance method:

Depreciation Expense = (Book Value at Beginning of Year * Depreciation Rate)

- Book Value at Beginning of Year: The value of the asset at the start of the fiscal year.

- Depreciation Rate: Usually set at double the straight-line rate, this rate accelerates the depreciation expense.

Depreciation Methods Table

| Method | Formula | Description | When to Use |

|---|---|---|---|

| Straight-Line | Depreciation Expense = (Cost of Asset – Salvage Value) / Useful Life | Allocates the cost evenly over the useful life of the asset. | When asset’s economic benefits are expected to be uniform over its life. |

| Declining Balance | Depreciation Expense = Book Value at Beginning of Year * Depreciation Rate | Accelerates the depreciation charges, higher expenses in the earlier years. | When asset’s productivity declines or maintenance costs increase over time. |

| AMT Straight-Line | Depreciation Expense = (Cost of Asset – Salvage Value) / AMT Useful Life | Similar to straight-line but uses a different useful life defined under AMT rules. | Specifically for AMT calculations to ensure minimum tax liability is met. |

| AMT 150% Declining Balance | Depreciation Expense = Book Value at Beginning of Year * 1.5 * (Straight-Line Rate / 100) | A hybrid method that combines the declining balance and straight-line methods, used under AMT rules. | To accelerate depreciation under AMT, balancing tax benefits and liabilities. |

Example of AMT Depreciation Calculator

Consider a machine purchased for USD 10,000 with a salvage value of USD 2,000 and a useful life of 5 years. Using the straight-line method:

Depreciation Expense = (10,000 – 2,000) / 5 = 1,600 per year

Using the declining balance method with a rate of 40%:

Year 1 Depreciation Expense = 10,000 * 0.40 = 4,000

The example shows that the declining balance method accelerates the depreciation expense, impacting the taxable income more significantly in the earlier years.

Most Common FAQs

AMT Depreciation recalculates depreciation to limit reductions in taxable income, ensuring that taxpayers contribute a baseline amount of tax.

Use the formulas provided for the straight-line or declining balance methods to determine the depreciation expense under AMT rules.

Yes, by increasing taxable income through accelerated depreciation, AMT Depreciation can lead to higher tax liabilities, especially in the early years of an asset’s lifespan.