In personal finance, understanding your monthly income after all deductions is critical for effective budgeting and financial planning. The Adjusted Monthly Income Calculator simplifies this process by providing a clear, concise calculation of your net monthly income after all significant deductions are considered. This tool is invaluable for anyone needing to make informed decisions about spending, saving, or investing based on their actual take-home pay.

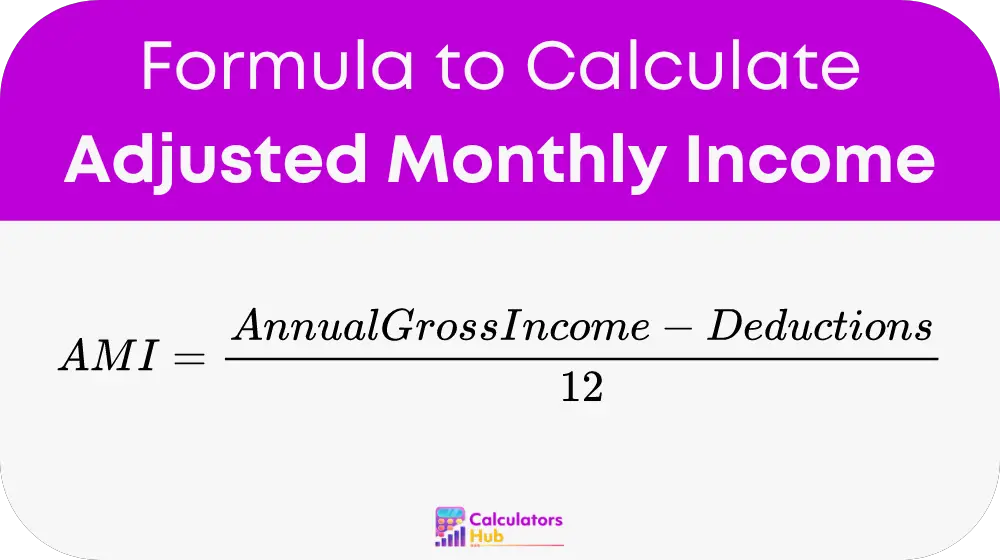

Formula of Adjusted Monthly Income Calculator

The formula for calculating Adjusted Monthly Income is:

Here's what each component means:

- Annual Gross Income: This is the total income earn in a year before any taxes or other deductions are apply.

- Deductions: These are expenses deduct from the gross income, including taxes, retirement contributions, medical expenses, and other allowable deductions.

Detailed Steps for Calculation

- Determine Annual Gross Income: Total up all sources of income over the year.

- Identify Deductions: Sum up all applicable deductions over the year.

- Calculate Adjusted Monthly Income: Subtract the total deductions from the annual gross income and divide by 12 to get the monthly figure.

Table for General Terms and Quick Calculations

To provide users with instant access to commonly needed values without the need for manual calculations, here's a useful table:

| Annual Gross Income | Deductions | Adjusted Monthly Income |

|---|---|---|

| $60,000 | $10,000 | $4,166.67 |

| $120,000 | $30,000 | $7,500.00 |

| $90,000 | $20,000 | $5,833.33 |

This table helps illustrate how different levels of income and deductions affect the final monthly income, aiding in quicker financial assessments.

Example of Adjusted Monthly Income Calculator

Imagine an individual with an annual gross income of $100,000 and total deductions of $25,000 for the year. Using our formula:

Adjusted Monthly Income = ($100,000 - $25,000) / 12 = $75,000 / 12 = $6,250

This example shows how the calculator can be use to quickly determine the net monthly income, which is essential for budgeting purposes.

Most Common FAQs

A1: It helps individuals understand what they actually earn each month after all deductions, which is crucial for managing personal finances effectively.

A2: Yes, the Adjusted Monthly Income Calculator is versatile and can be adapt for any income level and deduction scenario, making it useful for a wide range of financial planning needs.

A3: Estimate the average or typical deductions for the year as accurately as possible to reflect the most realistic monthly income.