The Adjusted Gearing Ratio is a critical financial metric used by investors, analysts, and business managers to assess a company’s financial leverage considering its liquid assets. This ratio refines the traditional gearing ratio by adjusting for cash and equivalents, providing a more accurate picture of how leveraged a company is when its readily accessible funds are considered. It’s particularly useful in evaluating the risk and financial structure of a company, helping stakeholders make informed decisions regarding investment and management strategies.

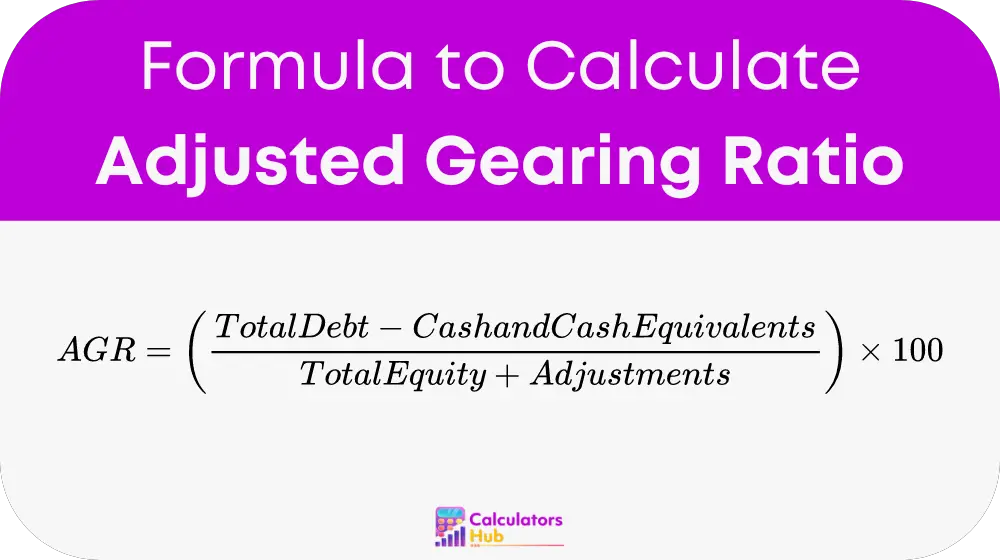

Formula of Adjusted Gearing Ratio Calculator

The formula for calculating the Adjusted Gearing Ratio is as follows:

Here’s a breakdown of the components:

- Total Debt: The sum of all short-term and long-term financial obligations.

- Cash and Cash Equivalents: Highly liquid assets that are readily convertible into cash.

- Total Equity: The total net worth or shareholders’ equity in the company.

- Adjustments: This may include items like preferred shares, minority interests, or other specific financial adjustments.

Detailed Steps for Calculation

- Identify Total Debt: Sum up all the debts of the company, including bonds, loans, and other credit facilities.

- Determine Cash and Cash Equivalents: Calculate all liquid assets that can be immediately converted into cash.

- Calculate Total Equity: This is generally the total assets minus total liabilities, adjusted for any specific equity items.

- Make Necessary Adjustments: Add or subtract any special items that are relevant to your financial analysis.

- Compute Adjusted Gearing Ratio: Apply the formula to find out the percentage of debt adjusted for liquidity and other factors relative to the company’s equity.

Table for General Terms and Quick Calculations

To facilitate easier understanding and application of the Adjusted Gearing Ratio without manual calculations every time, here is an illustrative table:

| Total Debt ($M) | Cash and Equivalents ($M) | Total Equity ($M) | Adjustments ($M) | Adjusted Gearing Ratio (%) |

|---|---|---|---|---|

| 500 | 50 | 450 | 20 | 95.74% |

| 1000 | 200 | 800 | 0 | 100% |

| 200 | 20 | 180 | 10 | 94.44% |

This table shows various scenarios to help users quickly gauge the financial leverage of different company profiles.

Example of Adjusted Gearing Ratio Calculator

Consider a company with $800 million in total debt, $100 million in cash and equivalents, $700 million in total equity, and $50 million in adjustments. Using our formula:

Adjusted Gearing Ratio = ((800 – 100) / (700 + 50)) * 100 = (700 / 750) * 100 = 93.33%

This calculation shows the company is significantly leverage, adjusting for its liquid assets and specific equity adjustments.

Most Common FAQs

A1: It provides a more nuanced view of a company’s leverage by accounting for its liquid assets, which is vital for assessing financial health and risk.

A2: Unlike the traditional gearing ratio, the adjusted version accounts for cash and equivalents, offering a clearer picture of actual financial leverage.

A3: Consider any financial items that affect equity or debt but are not capture in standard financial statements. Like minority interests or preferred shares.